Financial strength:

Sector: Consumer Discretionary

Index: DJI

Market cap: 204.71B

Revenue: 88.98B

P/E: 67.22

Debt to Equity: 0.47

Business Description:

Walter Elias Disney was an American animator, film producer, and entrepreneur, who played a pioneering role in shaping the American animation industry. He introduced numerous advancements in cartoon production methods.

Walt Disney and his brother Roy established the Disney Brothers Cartoon Studio in Hollywood, California, on October 16, 1923. This studio, which later evolved into the Walt Disney Company, has left an immense mark on the entertainment sector and has grown to become one of the largest media conglomerates globally.

Walt Disney, driven by an insatiable desire for innovation, expanded his ventures beyond successful motion pictures and television programs. Inspired by his experiences as a father unable to fully engage in amusement park activities with his daughters, he conceived the idea of a park where both parents and children could enjoy themselves together. This vision led to the creation of Disneyland, which opened its doors on July 17, 1955, after years of meticulous planning and construction.

Disneyland revolutionized the concept of amusement parks, earning it the designation of a “theme park.” Its unprecedented design and immersive experiences have set a benchmark for the industry, garnering worldwide acclaim, and drawing in millions of visitors since its inception.

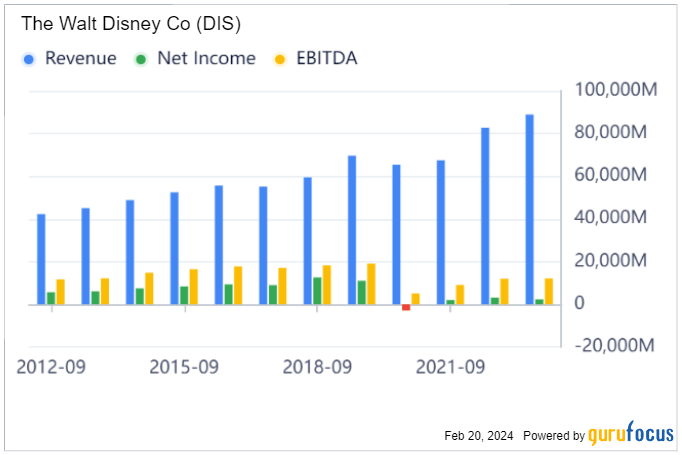

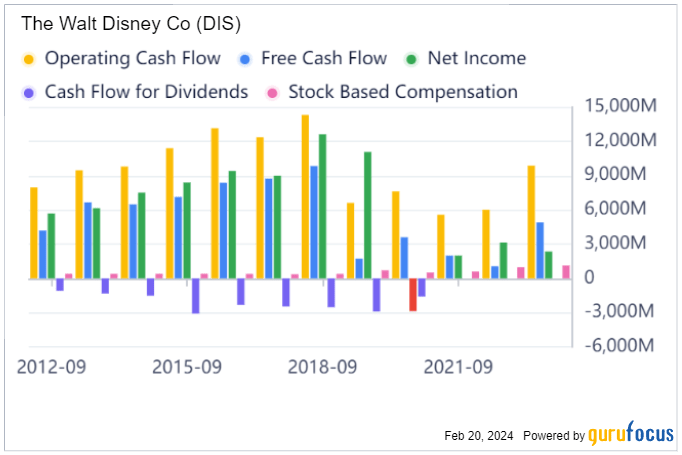

Historical Performance:

Financial Highlights: Fourth Quarter 2023:

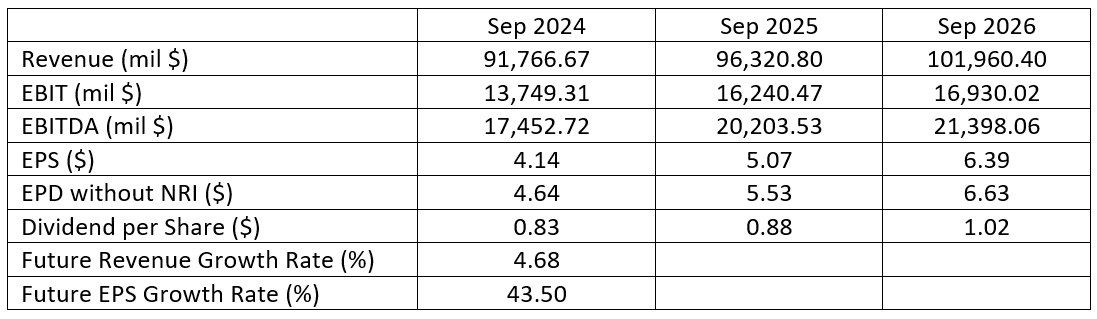

Analysts are expressing optimism regarding Disney’s business outlook and stock performance for 2024. Projections indicate a full-year adjusted EPS of $4.49, marking an increase from $3.47 in 2023. Additionally, revenue forecasts for Disney in 2024 stand at $88.27 billion, reflecting a 5.2% year-over-year growth.

In September 2023, media entrepreneur Byron Allen extended a $10 billion offer to purchase the ABC television network, FX, National Geographic cable channels, and local TV stations from Disney. While Disney has yet to decide regarding a potential ABC sale, analysts, like Jamie Lumley from Third Bridge Group, suggest that proceeds from such a sale could be utilized to finance the acquisition of Comcast’s one-third stake in Hulu, estimated to cost approximately $8.61 billion.

Disney plans on doubling down on its quest for streaming dominance diversifying and expanding the content base to appeal to wider audience range. While expanding its streaming platform, Disney intends to expand on franchises such as Marvel, Stars Wars, Pixar and other animation film classics to target an audience that holds a tremendous sentimental value.

Disney theme parks, renowned for their immersive and innovative experiences will, are set to be commissioned in more locations with an enhanced experience for the millions of tourists they attract every year.

In order to facilitate these ambitions, Disney recognizes and is incorporating contemporary technology such as virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) to improve its immersive and entertaining experience as well as introduce a higher level of operational efficiency.

The cream of the crop is in a term Walt Disney coined at ‘imagineering’. This involves a unique blend of imagination and engineering that goes into creating the immersive experiences found in Disney theme parks and attractions. It encompasses the creative and immersive story through detailed environments, interactive experiences, and seamless storytelling experiences.

Disney is at the forefront of incorporating cutting edge technology to enhance its entertainment experience from efficient administrative operations to delivering a seamless theme park experience. This makes Disney an exciting prospect which will reflect positively in its recently underperforming stock price.

TECHNICAL OUTLOOK:

Recommendation: Buy

CMP: 111.56

Stop Loss: 78

Target: 195 – 200

Timeframe: 6 to 8 months

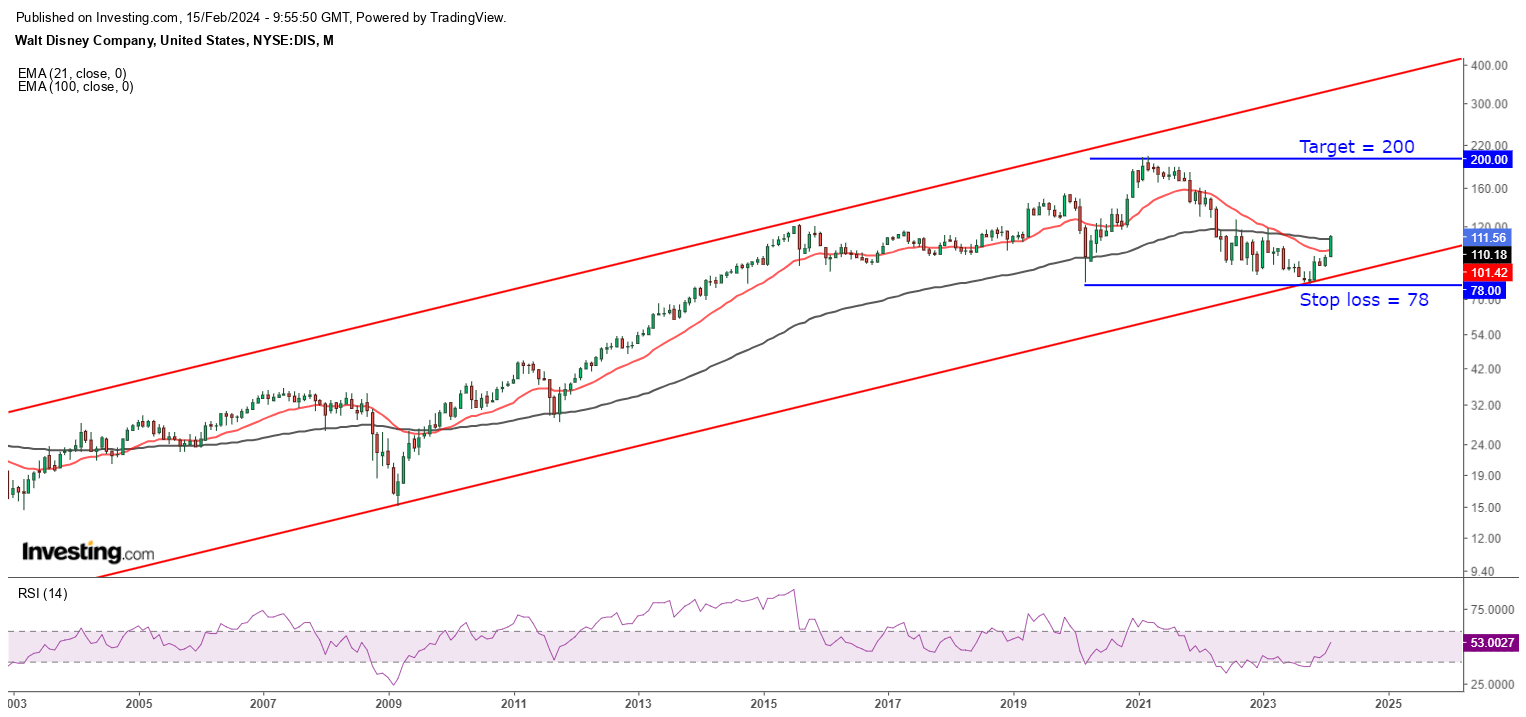

MONTHLY CHART:

The stock is currently following a pattern of higher tops and higher bottoms on the monthly chart. After testing the lower band of the rising channel, it has started to show positive momentum and the prices are now consistently above the 21 and 100 EMA, which indicates a change of trend on a higher timeframe.

Along with the price action, the momentum oscillator “Relative Strength Index” – (RSI) is witnessing a build-up in momentum as it is currently trading above 50 RSI.

Advise is to buy on a dip in the range of 105 – 100 zone with a stop loss at 78 and a target on the higher side can be expected at 195 – 200 levels in the coming 6 to 8 months.