Federal Reserve (Fed) policy is a major determinant of the overall health and stability of the US economy. The Fed uses a variety of fiscal tools to manage the money supply, interest rates, and credit conditions in the economy, all of which have direct and indirect effects on economic growth, inflation, and employment.

In this post, we will discuss some of the keyways that Fed policy impacts the economy of the US. Fed policy can have both positive and negative effects on the economy, and it’s important for policymakers to balance the risks and rewards of each policy tool to achieve the best overall outcomes for the economy and the American people.

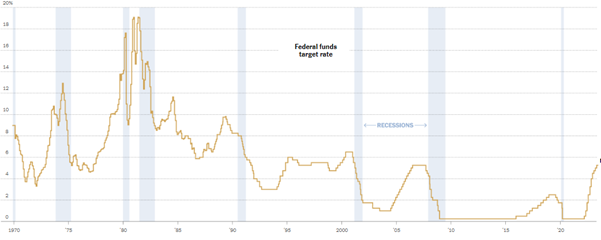

The Fed sets the benchmark federal funds rate, which is the rate at which banks can borrow cash from one another overnight. This rate has ripple effects throughout the economy, influencing interest rates for consumers and businesses, mortgage rates, bond yields, and the value of the U.S. dollar. Higher interest rates tend to slow economic growth and lower inflation, while lower interest rates tend to stimulate economic growth and contribute to higher inflation.

Due to the Federal Reserve’s attempts to boost the economy after the financial crisis of 2007-2008, the banking system’s reserve supply expanded significantly. The excess is substantial enough that many banks possess more reserves than necessary to satisfy reserve mandates. In such a context of surplus reserves, conventional open market operations that alter the reserve supply were insufficient in regulating the federal funds rate. Instead, the interest rate offered on reserves that banks keep at the Fed can be modified to sustain the targeted funds rate.

Over the last 14 months, the Federal Reserve has announced ten consecutive rate hikes, driving its benchmark interest rate to around 5.1%, which is the highest it has been in 16 years.

The rate increases have resulted in higher costs for mortgages, auto loans, credit card borrowing, and business loans. The Federal Reserve’s objective is to curb spending, stabilize the economy, and decrease inflation through the implementation of higher interest rates.

The high interest rate policy will likely cause both consumers and businesses to reduce their spending due to increased rates in the months ahead, which can lead to a decline in earnings and a drop in stock prices. Conversely, a substantial increase in interest rates will also lead to decreased inflation levels that is the main target of the feds for implementing this policy.

The Fed policy also impacts the economy by buying or selling securities, such as Treasury bonds, on the open market.

When the Fed buys securities, it pumps more money into the system, which can contribute to higher inflation. When the Fed sells securities, it drains money out of the system, which can help tame inflation.

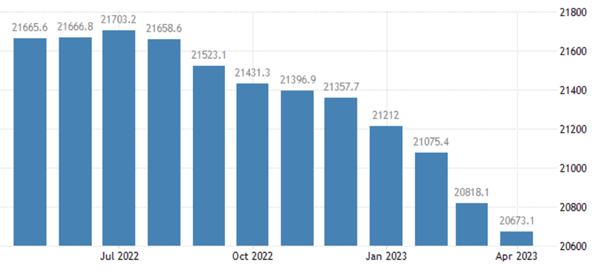

From 1959 to 2023, the United States’ Money Supply M2 had an average of 5021.74 USD Billion, and in July of 2022, it achieved its highest recorded value of 21703.20 USD Billion.

Image: Source

But the latest data shows that the Money Supply M2 in the United States declined to 20,673.10 USD Billion in April from 20,818.10 USD Billion in March 2023.

When the money supply contracts, prices tend to fall, which can be a good thing in moderation but can lead to a sustained decline in prices known as deflation.

Deflation can be damaging to the economy, as it can lead to a vicious cycle where consumers hold off on making purchases, hoping for even lower prices in the future, which can further stimulate deflation.

On the other hand, a decrease in the money supply can help stabilize the economy and reduce inflation. As the money supply diminishes, borrowing costs increase, resulting in higher expenses to maintain debt resulting in a reduction in consumer and business spending.

The policy of decreasing monetary supply will help in containing Inflation in the US can erode the value of money and make it more difficult for businesses and consumers to plan for the future. The decrease in monetary policy will probably tame the inflation rate from 4 percent at present to the Fed’s target rate of 2 percent.

The Fed influences the availability and cost of credit, which is a key determinant of economic growth and employment. By adjusting interest rates, the Fed influences the cost of borrowing for banks, businesses, and consumers, which in turn affects the willingness of these groups to borrow and spend money.

The current credit rating trends have taken a negative turn, and there is an anticipated increase in the U.S. speculative-grade corporate default rate to 3.75% by September of the following year.

Corporate borrowers are finding it challenging to pass on the increased costs due to the impact of high food and energy prices on discretionary spending. Additionally, the lack of market liquidity is becoming a growing concern for many lower-rated borrowers.

Lisa Cook, the Governor of the U.S. Federal Reserve Board, remarked in June 2023 that the Fed is closely monitoring credit conditions and will consider the possible economic adversities arising from the recent turbulence in the banking sector.

If the economy is constrained by stricter credit conditions, the appropriate trajectory for the federal funds rate might be lower than it would have been without such constraints. Conversely, if the data indicate persistent economic growth and decelerated disinflation, additional measures will be necessary.

The effects of a Fed monetary policy can be both positive and negative, and it’s important for business owners and policymakers to carefully balance the risks and benefits of monetary policy to achieve the best overall outcomes for the economy and the American people.

The failure of Silicon Valley Bank and other local banks at the start of this year shows that the fed policy is putting pressure on financial firms to perform. Companies that adjust to the strict credit conditions will survive, which requires a concentration on economic data with a prospective analysis.