Financial strength:

Sector: Chemicals Index: NIFTY 500 Market cap: ₹33,374 Cr

Income: ₹820 Cr Sales: ₹7,462 Cr P/E: 42

Debt/Equity: 1%

Business Description:

Deepak Nitrite Limited is an India-based company, which is engaged in manufacturing and trading of chemicals. The Company operates into two segments: Advanced Intermediates and Phenolics.

Its Advanced Intermediates segment offers sodium nitrite, sodium nitrate, nitro toluidines, fuel additives, nitrosyl sulphuric acid, xylidines, oximes, cumidines, specialty agrochemicals, optical brightening agent (OBA), diamino stilbene disulfonic acid (DASDA). Its Phenolics segment offers cumene, phenol, acetone, isopropyl alcohol, ammonium sulfate (AMS).

The Company’s products cater to several industries, such as colorants, rubber chemicals, explosives, dyes, pigments, food colors, pharmaceuticals, diesel blending, agrochemicals, glass, personal care, paper, detergents and textiles, laminates, ply, adhesive, paints, auto, pharmaceuticals, plastics, and others. The Company’s manufacturing facilities are located at Nandesari, Dahej (Gujarat), Roha, Taloja (Maharashtra) and Hyderabad (Telangana).

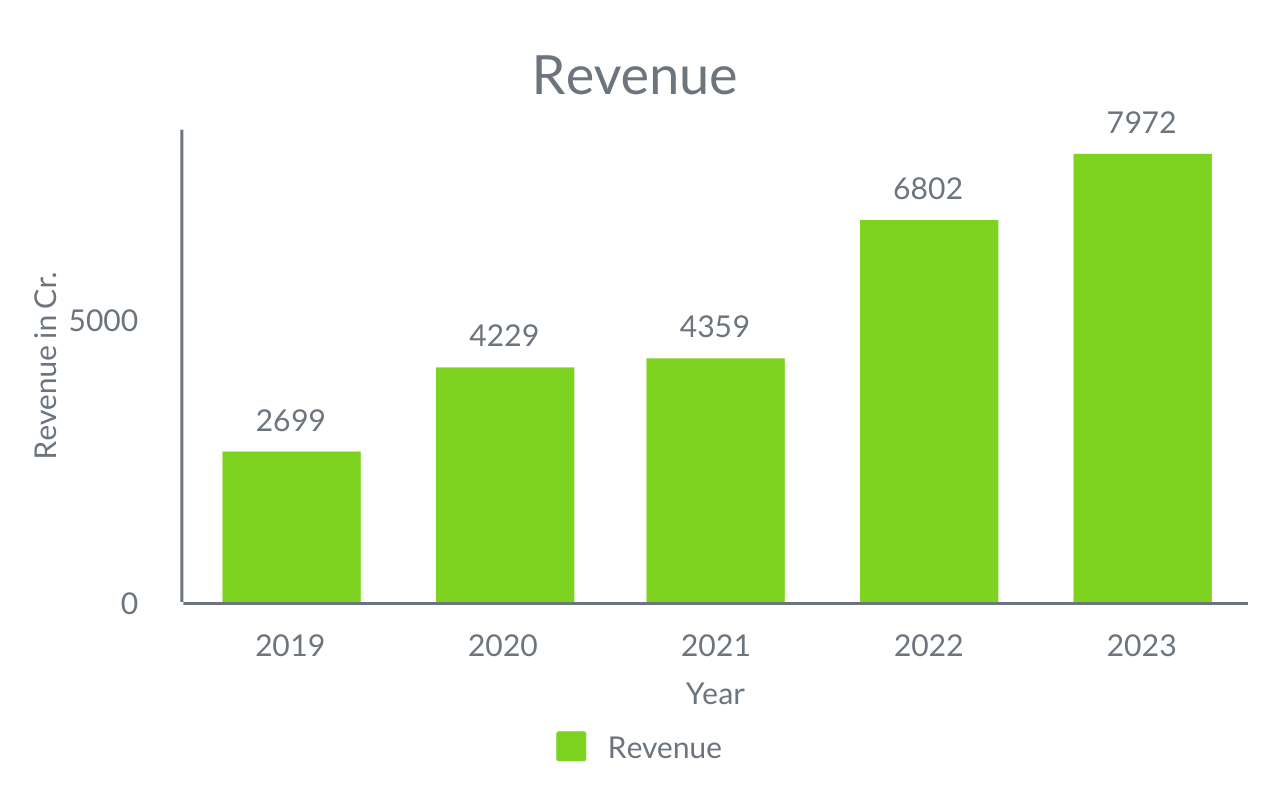

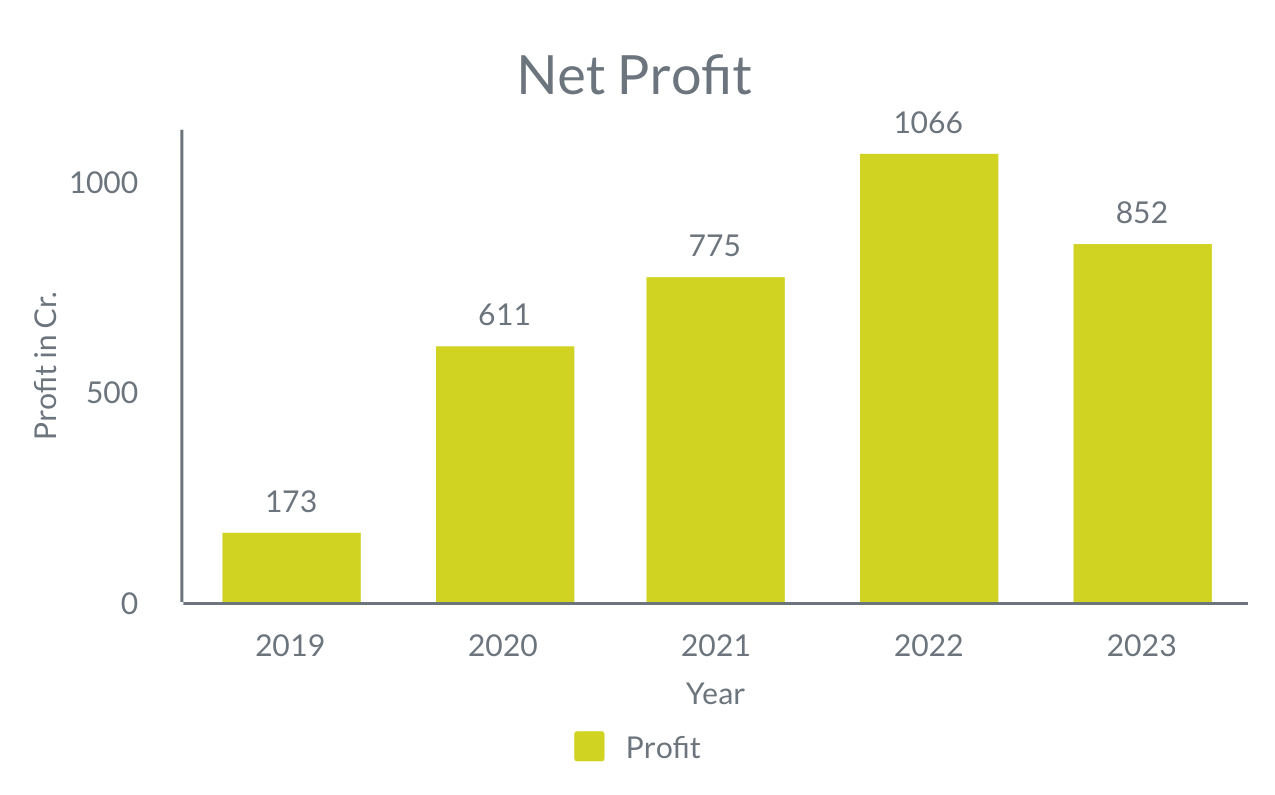

Financial Highlights:

Performance overview & other highlights:

TECHNICAL OUTLOOK:

Recommendation: Buy

CMP: 2447.95

Stop Loss: 1875

Target: 3875 – 3900

Timeframe: 5 to 6 months

WEEKLY CHART:

Stock was in long term consolidation pattern on weekly timeframe. Consolidation pattern was in the form of “Triangle pattern” marked with (red lines) A-B-C-D-E on the chart.

Price action of last two to three weeks has started building positive momentum, which is evident from momentum oscillator “Relative Strength Index” (RSI) below the chart, as it has started trading above the previous peaks and currently sustaining above 60 level on weekly chart.

Going forward, if prices manage to take some breather and retraces back near 2300 – 2200 zone then it would be good accumulation area.

Stop loss can be placed at 1875 on the lower side and one can expect target of 3875 – 3900 levels on higher side in coming 5 to 6 months.

Conclusion:

Deepak Nitrite has an operating revenue of Rs. 7,498.81 Cr. on a trailing 12-month basis. An annual revenue growth of 17% is outstanding, Pre-tax margin of 14% is healthy, ROE of 20% is exceptional. The company has a reasonable debt to equity of 1%, which signals a healthy balance sheet.

The stock from a technical standpoint is comfortably placed above its key moving averages, around 12% and 19% from 50DMA and 200DMA. It has recently broken out of a base in its weekly chart which suggest build-up in price momentum.