A strong dollar may seem like it’s good for the economy. But in reality, a strong dollar does more harm than good for the US economy. In fact, many experts believe the dollar has now become too strong for its own good.

As a tourist, a strong dollar is a good news. You get to enjoy a better value package for your visit abroad. However, a stronger dollar is unquestionably bad news for businesses and investors. In this blog, we will look at how a strong dollar impacts the US economy.

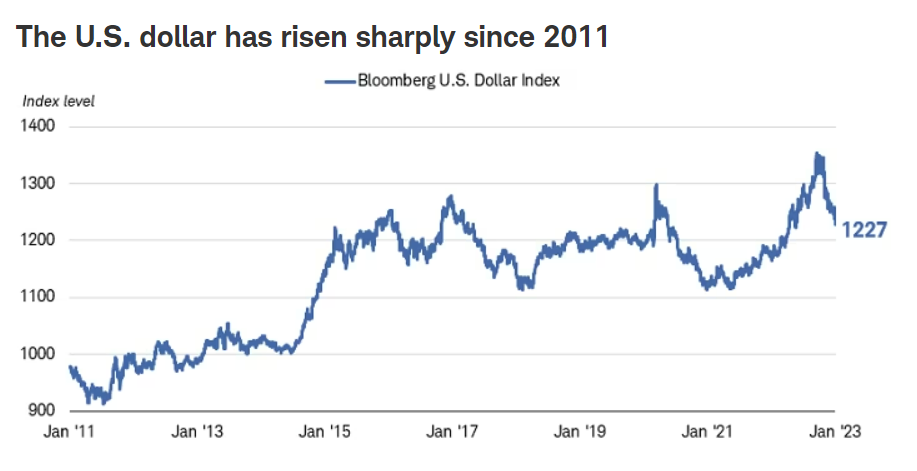

The value of the US dollar has increased significantly since 2011 as compared to many major currencies, such as the euro, the pound, and the yen.

The Wall Street Journal’s Dollar Index shows that the US dollar has increased by almost 16 percent in 2022. Between 2011 and 2022, the U.S. dollar strengthened by about 50% versus major currencies.

The dollar is at its highest point in 20 years relative to other currencies. In contrast, as of March 2023, the pound is at its lowest point versus the dollar since 1985, the yen is at its lowest position against the dollar since 1998, and the euro is at its lowest point versus the dollar since 2002.

Typically, a currency value rises when the demand for local goods is high abroad. This results in an increased net flow of money for a country boosting the local economy. Exports rise that supporting the nation’s short-term economic growth with a greater inflow of money to support domestic production.

However, growing exports are not what’s driving the gain in dollar value since 2011.

When the bond and stock markets become unstable, many investors flock to the dollar as a safe asset. That’s in part due to the dollar’s special status as the “reserve currency” of the globe. Financing and investing abroad are made possible by utilizing a single dollar currency rather than having to convert between them.

The dollar has been increasing in value due to investor demand rather than the demand for goods. This is not a good sign for the overall US economy.

A rising dollar makes goods made in the US more expensive for international customers. The result is a decrease in the demand for goods abroad. It hurts export demand and costs American firms dearly.

As their goods and service have become costly for overseas customers, US exporters and companies with global operations are suffering losses.

Nearly about 30% of US corporations’ revenues originate from abroad. And many US exporters and businesses with a global presence are experiencing losses due to decreased demand.

Foreign income will be translated into fewer dollars when the dollar strengthens.

A strong US currency reduces the purchasing power of foreign nations in buying American-made goods. Lower demand for American exports results when exported goods become less affordable. The overseas customer will look for local alternatives or put off buying completely. This negatively affects the trade balance of the country.

The U.S. trade imbalance expanded in 2012 as imports climbed and exports of products dipped to 10 month low.

Trade imbalance climbed 12.2 percent to over 1 trillion dollars in 2022. The value of imports rose by $556.1 billion to $4 trillion, while exports rose marginally to $3 trillion.

In 2022, the U.S.-Canada goods trade imbalance increased from $31.6 billion to $81.6 billion. The $382.9 billion goods trade deficit with China increased by $29.4 billion.

The surge in cheap mobile phone imports helped to enhance imports as China’s supply increased when the nation was reopened after being closed to prevent COVID-19 outbreaks. Motor vehicle, component, and engine imports also increased by $2.9 billion.

American-made goods are now more expensive abroad due to the strengthening of the U.S. dollar which is reducing demand for US-made goods overseas.

Many people who live overseas are hesitant to buy American-made goods since they are more expensive than those they can find locally or from other nations, notably China.

In contrast, the strengthening dollar makes US imports less expensive, which hurts local firms.

Exporters from abroad can lower their pricing in US dollars while still increasing their earnings in their currencies due to strengthening dollar value. Because of the high dollar, imported items are less expensive for Americans than domestically produced ones. As a result, local businesses see diminishing earnings and more job losses.

The strong dollar slows economic development.

Because of a stronger currency, US businesses in both manufacturing and services suffer. For instance, Microsoft Corp. stated that a high dollar lowers its net sales in its earnings report from last month.

Businesses in the US that serve tourists, such as hotels, resorts, and vehicle rental agencies, discover that travelers from other countries have less money to spend resulting in reduced revenues

The high value of the dollar since late 2011 has acted like a massive tax on U.S. exports and a huge subsidy to U.S. imports. As a result, although U.S. manufacturing firms have made substantial investments in new technologies and U.S. manufacturing workers have vastly increased their productivity, these achievements have not paid off in the face of foreign products that have been selling at deep, artificial discounts created by the overvalued dollar.

A strong U.S. dollar makes goods costly abroad, making it harder for businesses that sell goods to consumers abroad.

The cost of converting payments made to overseas customers from their native countries’ local currencies to dollars is rising. As a result, the U.S. firm is finding it difficult to maintain its competitiveness versus domestic alternatives as the currency acquires strength.

A drop in the value of the dollar – or at least a stable currency value – will provide the American economy a much-needed boost. The U.S. manufacturing and IT industries have experienced dreadful effects such as decreased earnings, lost employment, and decreased investment as a result of the dollar’s overvaluation for the previous few years.

But unlike China which aggressively intervene to maintain a fixed exchange rate, the US government had adopted a laissez-faire approach relying on the ‘invisible’ hand to determine the dollar value. So, the prospect of the dollar decreasing in value in the near future does not look good.