Financial strength:

Sector: Technology Index: NDX Market cap: 269.93B

Revenue: 19.41B P/E: 50.57

Debt to Equity: 0.25

Business Description:

Adobe Inc. is a global leader in digital media and marketing solutions, empowering individuals and businesses to create, deliver, and optimize content and applications. Founded in 1982, Adobe has consistently pioneered innovative technologies that redefine the way people engage with digital information.

Headquartered in San Jose, California, Adobe serves a diverse customer base, ranging from individual creatives to large enterprises. The company’s software and services are integral to industries such as media and entertainment, education, government, and e-commerce.

Adobe has been at the forefront of innovation in areas such as artificial intelligence (AI), machine learning, and augmented reality (AR). Adobe Sensei, the company’s AI and machine learning platform, powers intelligent features across its product offerings, enhancing creativity and productivity.

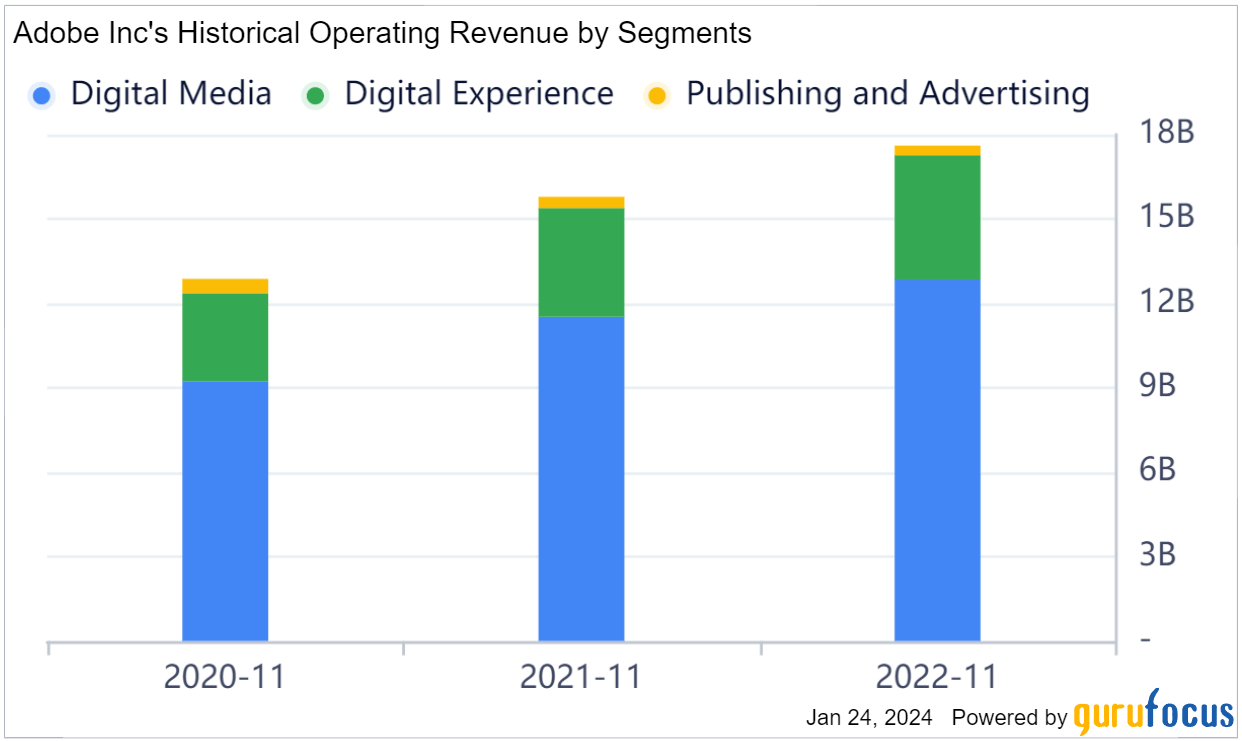

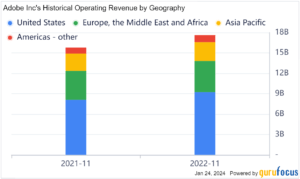

Historical Performance:

Financial Highlights: Q4 2023:

The company’s revenue aligned with the predictions made by analysts, and the earnings per share (EPS) exceeded analyst estimates by 1.0%.

Adobe’s forecasted average annual revenue growth is set to 9.9% over the next three years. This stands in contrast to the Software industry in the US, which is expected to grow at a rate of 12% during the same period.

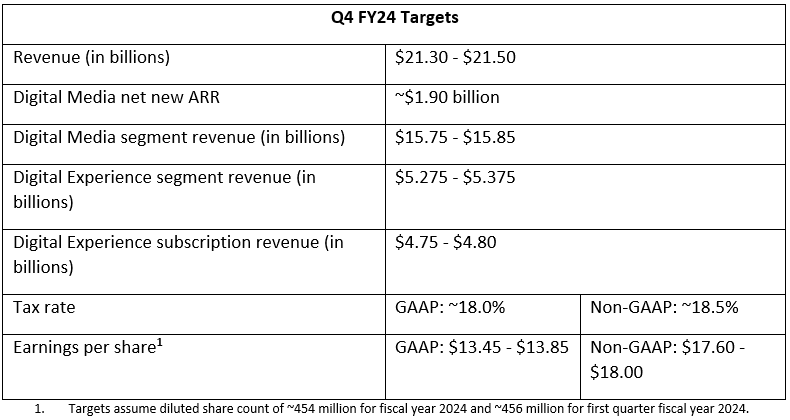

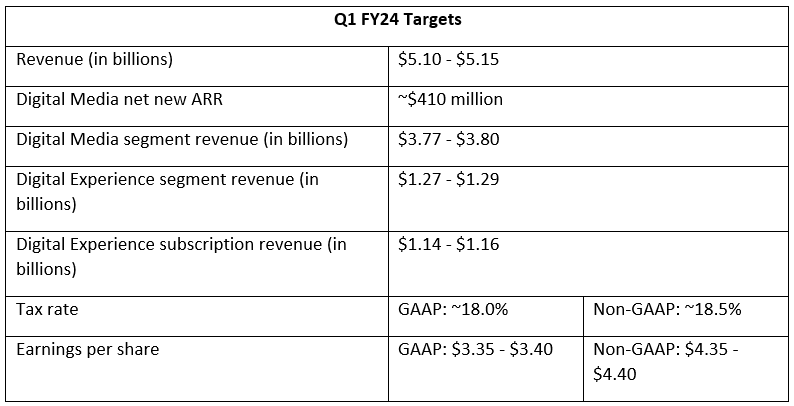

Business Outlook

The following table summarizes Adobe’s Q1 2024 financial projections.

TECHNICAL OUTLOOK:

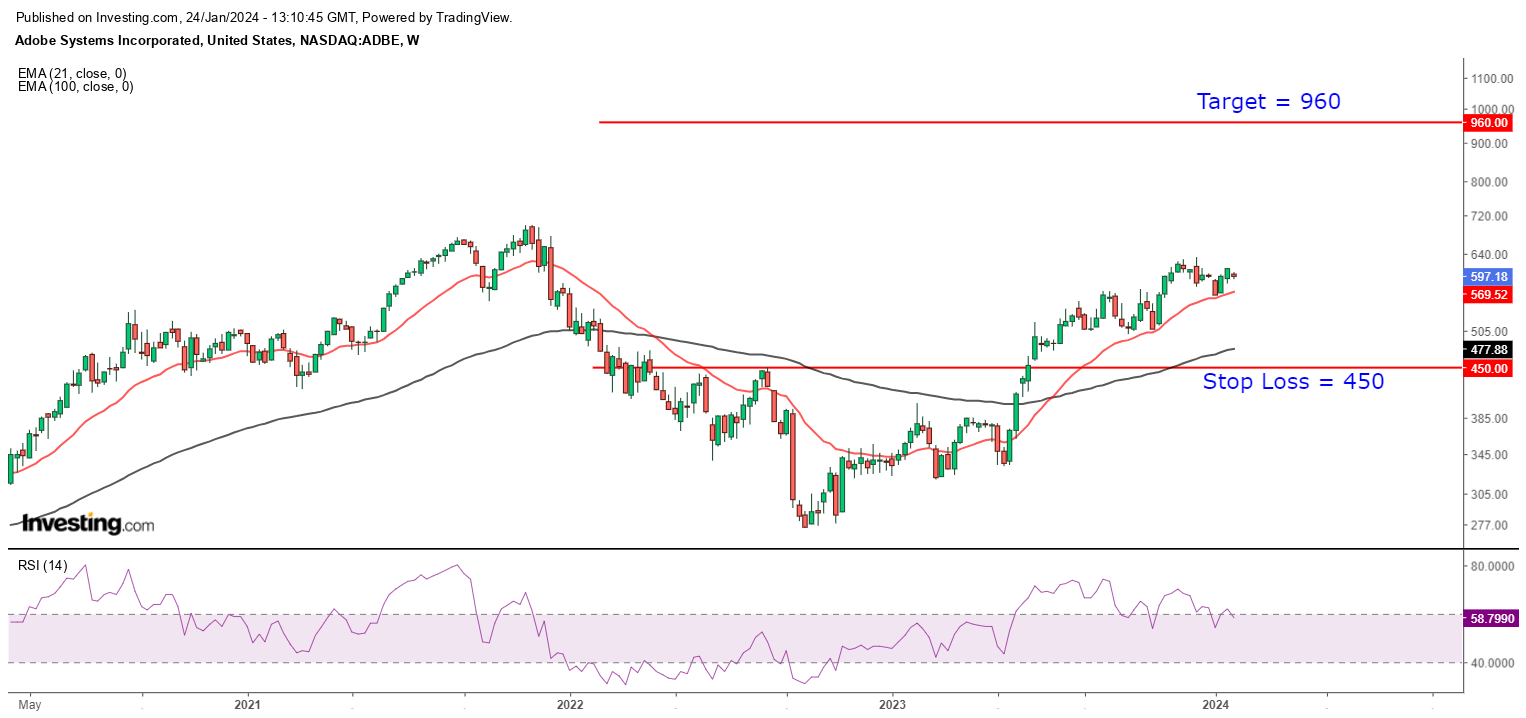

Recommendation: Buy

CMP: 597

Stop Loss: 450

Target: 960 – 1000

Timeframe: 6 to 8 months

WEEKLY CHART:

Stock is trading above short term i.e. 21EMA and long term i.e. 100EMA and at the same time, a positive crossover of moving averages is evident on the chart, which suggests positive price action will continue in the coming months.

We can see a build-up in negative divergence on the “Relative Strength Index – RSI” momentum oscillator highlighted in (black lines). Hence, the price can give some retracement towards the 550 – 520 area on the lower side however, it would be a buying opportunity.

The recommendation would be to buy on a dip in the range of 550 – 520 zone with a stop loss of 450 and one can expect a target of 960 – 1000 level on the higher side in the coming 8-10 months.

Conclusion:

Adobe achieved record revenue of $19.41 billion in FY23, experiencing 17% YoY EPS growth. The company had strong momentum across its Creative Cloud, Document Cloud, and Experience Cloud.

Technically Stock momentum is building up as it trades above the crucial trend line of 50-100-200 SMA.