Financial strength:

Sector: Technology Index: RUT Market cap: 5.10B

Income: 176.12M Sales: 1.59B P/E: 29.62

Debt/Equity: 0.32

Business Description:

The company was founded by Vikram Talwar and Rohit Kapoor in April 1999 and is headquartered in New York, NY. It is a business process management company that provides digital operations and analytical services to clients driving enterprise-scale business transformation initiatives that leverage the company’s deep expertise in analytics, AI, ML, and cloud. The company offers business process outsourcing and automation services, and data-driven insights to customers in multiple industries.

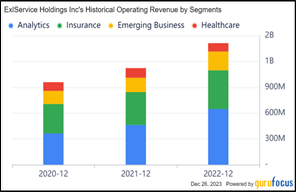

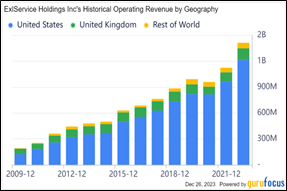

The company operates through four segments based on the products and services offered and markets served: Insurance, Healthcare, Emerging, and Analytics. The vast majority of the company’s revenue is earned in the United States, and more than half of its revenue comes from the Analytics segment.

Historical Performance:

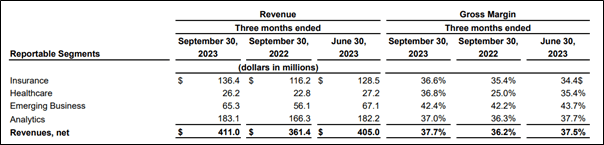

Financial Highlights: Third Quarter 2023:

Business Highlights Third Quarter 2023:

TECHNICAL OUTLOOK:

Recommendation: Buy

CMP: 30.92

Stop Loss: 24.00

Target: 53.00 – 55.00

Timeframe: 4 to 5 months

WEEKLY CHART:

Technically, stock is trading in higher top higher bottom formation on weekly timeframe since 2020 and after taking support on up-ward sloping channel formation (drawn in red line) in the month of Oct 2023, it has started showing positive build-up in price action.

If prices manage to sustain above 34.00 level on the higher side, then it will see further strong positive momentum.

It is suggested to create long position once its start’s sustaining above 34.00 level on higher side.

Stop loss will be placed at immediate support at 24.00 level and one can expect target of 53.00 – 55.00 levels on the higher side within the timeframe of 4 to 5 months.

Conclusion:

EXLS’s Q3 2023 earnings report shows a strong performance with significant growth in revenue and adjusted diluted EPS. The company’s robust performance and increased guidance for the full year 2023 reflect its strong momentum and position in the market.