Financial strength:

Sector: Energy Index: DJIA

Market cap: $283.39B

Revenue: $210.242B P/E: 11.16

Business Description:

Chevron Corporation operates as a comprehensive energy company involved in various aspects of the industry. The company engages in the exploration, development, production, and transportation of crude oil and natural gas. Additionally, Chevron is active in the manufacturing of transportation fuels, lubricants, petrochemicals, and additives. The company also focuses on developing technologies that benefit its operations and the overall industry.

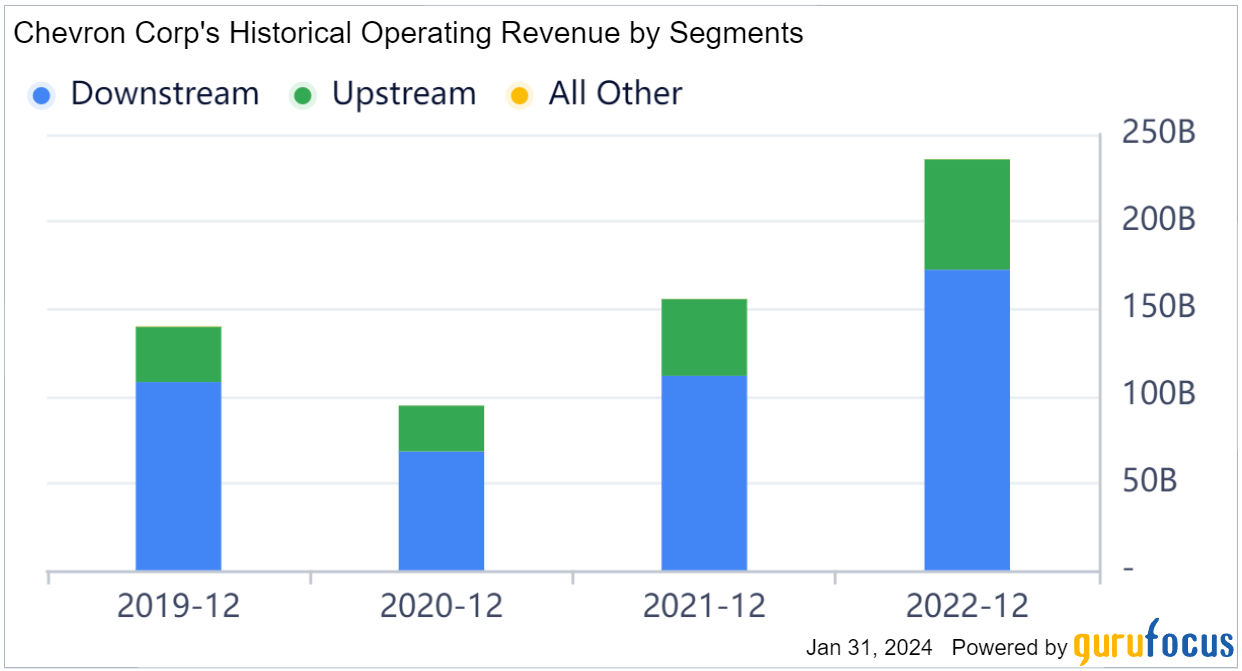

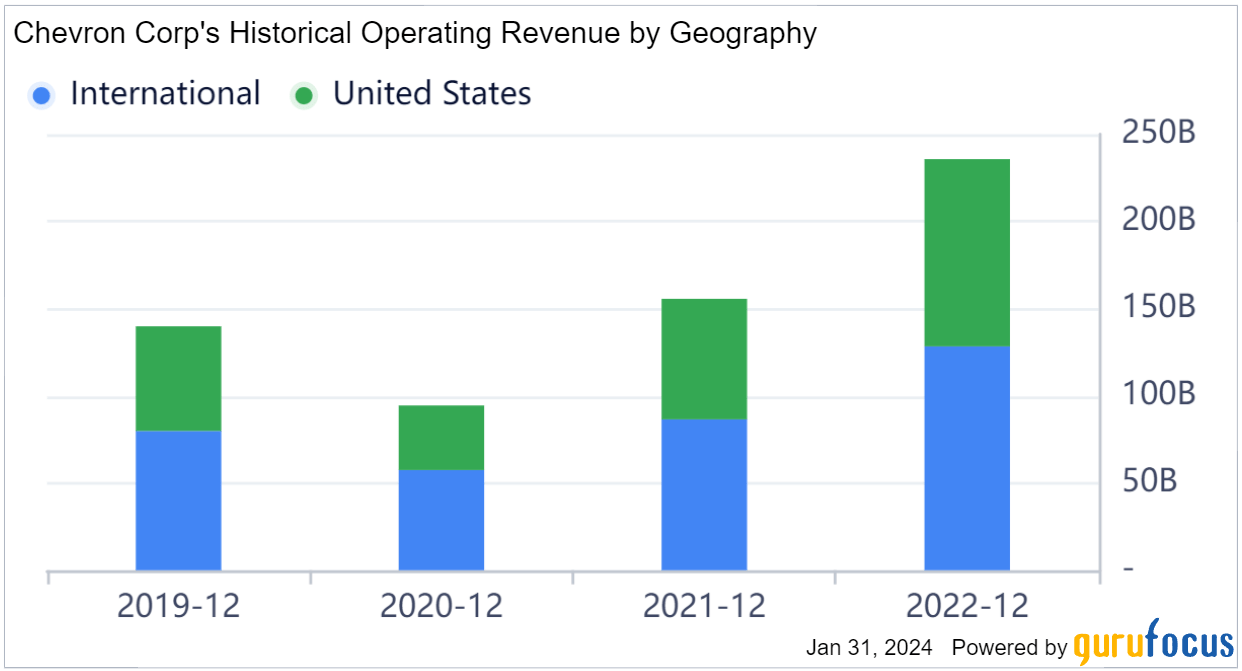

Within its Upstream operations, Chevron is involved in exploring for and extracting crude oil and natural gas, as well as the liquefaction, transportation, and regasification processes associated with liquefied natural gas (LNG). This segment also includes the international transport of crude oil through oil export pipelines, processing, transporting, storing, and marketing natural gas, along with the operation of a gas-to-liquids plant.

In the Downstream segment, Chevron is engaged in refining crude oil to produce petroleum products, marketing crude oil, refined products, and lubricants, and manufacturing and marketing renewable fuels, among other activities. The company is actively involved in various projects, such as Gorgon, Wheatstone, Jack/St. Malo, Tengiz Expansion, Big Foot, Permian Basin, and Angola LNG. Additionally, Chevron possesses approximately 275,000 net acres in the Denver-Julesburg (DJ) Basin.

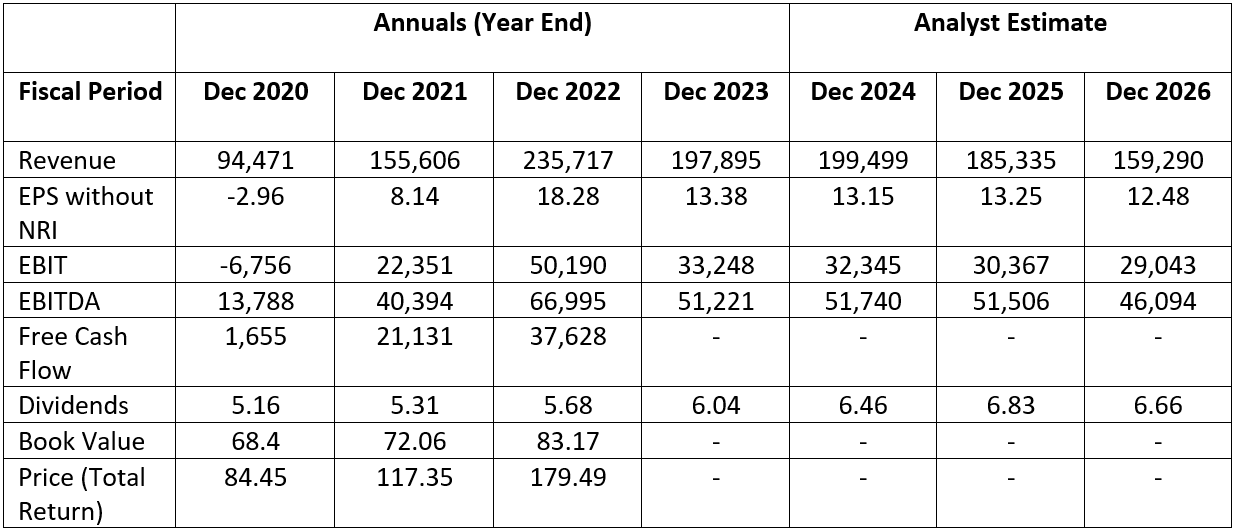

Historical Performance:

Financial Highlights: Q3 2023:

Business Outlook:

Chevron’s plans for 2024 indicate a significant increase in capital spending, aiming for global expenditures in the range of $18.5 billion to $19.5 billion. This represents an 11% increase from the $17 billion spent in 2023. The decision to raise capital spending follows Chevron’s substantial acquisitions in 2023, including the $53 billion purchase of Hess and the $6.3 billion acquisition of PDC Energy.

Post the acquisition of Hess, Chevron anticipates maintaining capital spending at a higher level, projecting it to be between $19 billion and $22 billion annually through 2027. This is a notable increase from the pre-Hess forecast of $14 billion to $16 billion. Chevron’s focus on capital discipline extends to both traditional and new energy ventures, as emphasized by Chevron’s CEO, Mike Wirth, in the December 6 announcement.

The breakdown of Chevron’s expected spending reveals approximately $14 billion for upstream activities in 2024, with about two-thirds allocated to the U.S. This includes around $5 billion earmarked for Chevron’s Permian Basin development. Downstream capital expenditures are forecasted to be roughly $1.5 billion, with 80% of that allocated to the U.S. Additionally, Chevron plans to allocate approximately $2 billion for “lower carbon” projects, consistent with the levels seen in 2023.

Despite the increased spending, Wall Street analysts project a decline in Chevron’s 2024 earnings, estimating them to total $14.46 per share, down 23% compared to 2022. Sales are also expected to drop by 15% to $201 billion in 2024.

In terms of production, Chevron anticipates producing around 3.54 million barrels of oil equivalent per day in 2024, reflecting a 14% increase compared to the 2023 expectation. Chevron had previously outlined plans in its annual investor day in February 2023 to achieve a 3% increase in total oil and gas production above current levels by 2027.

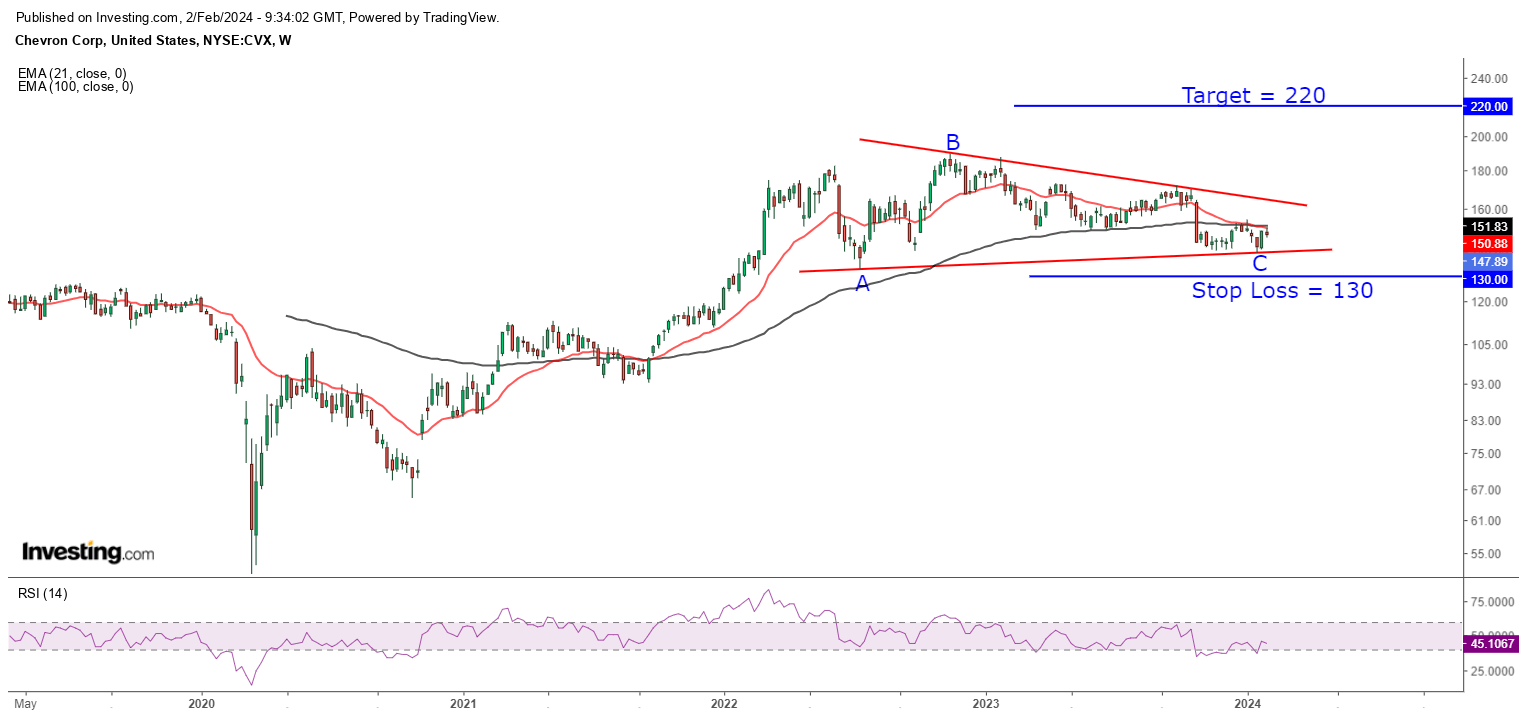

TECHNICAL OUTLOOK:

Recommendation: Buy

CMP: 150.12

Stop Loss: 130

Target: 210 – 220

Timeframe: 4 – 6 months

WEEKLY CHART:

Price has been in broader consolidation since June 2022 and currently trading near the previous swing low of 140 – 150 zone. In the previous week stock has started witnessing positive momentum and the probability is very high that it will see a continuation of positive momentum.

The recommendation is to create a long position at the current market price with a stop loss at 130 and one can expect a target of 210 – 220 level on the higher side in the coming 4 to 6 months.